In 2023, the personal loan market witnessed a substantial expansion, with total balances soaring to $241 billion — a nearly 15% increase from the previous year. This notable surge, coupled with a tightening of lending criteria due to higher delinquency rates, underscores the evolving complexities and demands within the financial landscape.

Such dynamics show the need for robust, adaptable loan management systems that can efficiently handle increased loan volumes, ensure compliance with stricter regulations, and manage risk effectively. In this article, we will guide you through the key steps on how to build a loan app that responds adeptly to these market changes, from understanding the basics to testing and launching the loan system. With GoodCore Software’s extensive expertise in the financial technology sector, we bring knowledge and experience to help you create a loan app that is secure, scalable, and user-friendly.

The Basics Of Loan App Development Explained

We’ll start off with the basics and answer the key question: what is loan management software?

A loan management software is a software solution designed to facilitate the end-to-end process of lending, encompassing various functionalities, including:

- Loan origination

- Underwriting

- Disbursement

- Repayment

- Monitoring

A well-designed lending system can automate and streamline these processes, reducing manual errors and improving efficiency. These systems play a pivotal role in the financial sector. They not only enable efficient loan management processes but also contribute to enhancing customer experience through quicker processing times and improved accuracy in decision-making.

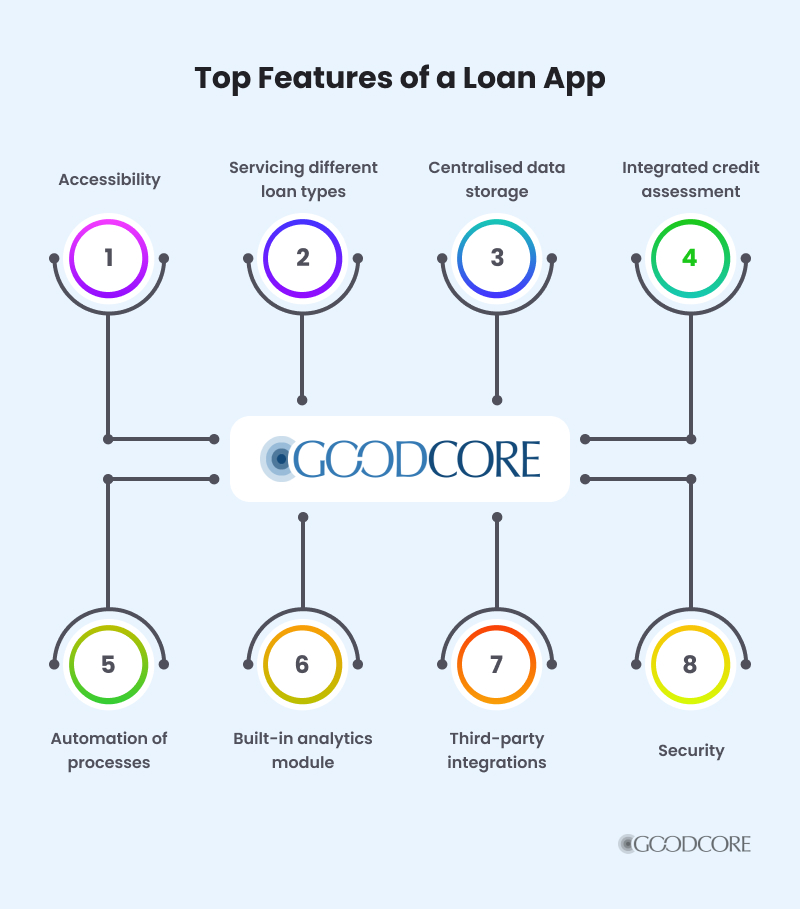

Key Features in Loan App Development

At GoodCore, we understand the importance of an efficient and well-structured loan lending app development. A robust system can streamline the lending process, improve customer experience, and enhance overall operational efficiency.

From our experience, successful loan management systems should include:

- Efficient loan application and approval processes. This component streamlines the intake of loan software for lenders and accelerates the approval process, minimising manual entry and reducing wait times. It ensures that applications are processed quickly and accurately, improving customer satisfaction and operational efficiency.

- Automated credit scoring and risk assessment. Utilises algorithms to assess the creditworthiness of applicants automatically. This system analyses financial history, credit scores, and other relevant data to determine the risk associated with each loan, enabling more consistent and objective decision-making.

- Real-time monitoring and reporting. Provides ongoing surveillance of loan performance and customer behaviour. This feature enables lenders to detect potential issues early, such as late payments or changes in borrower financial status, and respond promptly. It also supports compliance by ensuring that all transactions and interactions are logged and accessible for audits within the loan tracking software.

- Secure data management and compliance with regulatory requirements. Ensures that all customer data is securely stored and managed, protecting against breaches and unauthorised access. Compliance tools monitor and enforce adherence to relevant laws and regulations, helping financial institutions avoid legal penalties and reputational damage.

- Integration with external systems and APIs. Allows the loan management system to connect seamlessly with other software and services, such as banking systems, credit bureaus, and payment gateways. This integration facilitates the sharing and updating of information across platforms, enhancing the system’s functionality and user experience.

These features form the backbone of a robust loan software, ensuring that financial institutions can operate seamlessly while adhering to industry best practices and regulatory standards.

The Importance Of Creating A Well-Structured Loan App

A well-structured loan management system is crucial for efficient lending operations. It provides a clear framework for managing the entire loan lifecycle, ensuring consistent processes, and minimising errors. Additionally, an organised system architecture allows easy integration with other systems and provides a foundation for future enhancements.

Furthermore, a well-structured loan management platform enhances data security and confidentiality, safeguarding sensitive customer information from potential cyber threats and breaches. This aspect is particularly significant in today’s digital age, where data privacy and protection are paramount concerns for both financial institutions and their customers.

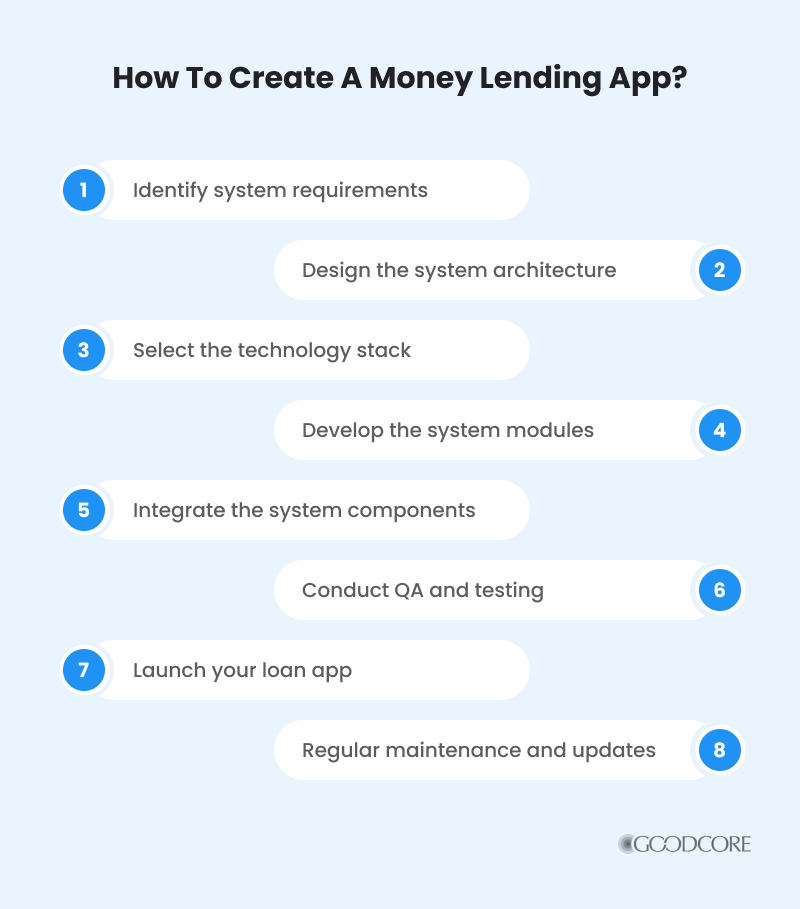

How To Create A Money Lending App – Key Steps

Building any financial software requires careful planning and execution. Let’s look at the key steps involved in the development of the loan management system software:

Step 1: Identifying your system requirements

When approaching the question of how to start a loan app, the first step is to define your system requirements based on your business objectives and operational needs. This includes the following.

Loan Categories

Determine which loan types (e.g., personal, auto, mortgage, business loans) the system will support. Each loan type may have unique requirements, interest rates, and repayment terms. Clearly defining the loan categories will help you tailor the application process, underwriting criteria, and risk assessment strategies. Here are some categories you can consider:

| Personal loans | Can be used for a variety of personal expenses and usually does not require collateral. |

| Auto loans | Specific for purchasing vehicles, typically requiring collateral (the vehicle itself). |

| Mortgage loans | Long-term loans used for purchasing real estate, secured by the property. |

| Business loans | For business purposes, which can include start-up loans, working capital loans, and equipment financing. |

Workflows

Define the loan approval process, including application submission, verification, approval, disbursement, and repayment tracking. A well-defined workflow ensures a smooth and efficient loan approval process, reducing processing time and improving user experience. It helps in maintaining consistency and transparency throughout the loan lifecycle.

User Roles and Permissions

Identify the roles and implement Role-Based Access Control (RBAC) to ensure that users can only access features relevant to their roles. Some roles to identify are:

- Administrator: Full access to all system features, including user management and system configuration.

- Loan Officer: Access to loan application reviews, verifications, and approvals.

- Customer Support: Access to user queries and basic loan information.

- Borrower: Access to apply for loans, check application status, and manage repayments.

RBAC ensures that users have access only to the information and features necessary for their roles, enhancing security and operational efficiency. It will prevent unauthorised access and potential data breaches.

Data Security

Protecting sensitive financial data is critical to maintaining user trust and complying with legal requirements. Plan data encryption, both at rest and in transit, to protect sensitive financial data. Encryption helps safeguard against data breaches and cyber-attacks.

- Encryption at Rest: Encrypt sensitive data stored in databases, file systems, and backups to protect it from unauthorized access.

- Encryption in Transit: Use SSL/TLS to secure data transmitted between the app, users, and backend services.

Regulatory Compliance

Compliance with relevant regulations is mandatory to avoid legal penalties and reputational damage. Review compliance requirements such as GDPR, CCPA, or specific financial industry standards like PCI DSS.

- General Data Protection Regulation (GDPR): Ensures data protection and privacy in the EU. Important for handling European user data.

- California Consumer Privacy Act (CCPA): Provides privacy rights and consumer protection for residents of California.

- Payment Card Industry Data Security Standard (PCI DSS): Ensures that all companies that process, store, or transmit credit card information maintain a secure environment.

Adhering to these standards ensures the app is secure, trustworthy, and meets industry best practices.

Step 2: Designing the system architecture

Once the requirements are clear, the next step is to design the system architecture for your lending management software. Here are the key steps to follow:

- System Architecture: Use microservices architecture to allow independent deployment and scaling of different modules.

- Database Design: Opt for a robust database management system (DBMS) like PostgreSQL or MongoDB for storing loan data securely and efficiently.

- APIs: Develop RESTful or GraphQL APIs for integration with third-party services (e.g., credit bureaus, payment gateways).

- Scalability: Implement load balancing and auto-scaling features to handle high transaction volumes.

- Integration: Design the system to integrate seamlessly with existing CRM, ERP, and accounting systems.

Step 3: Selecting the right software tools

Choosing the right software tools is crucial for the success of your loan management software. Evaluate different options based on their features, scalability, security, and compatibility with your existing IT infrastructure.

Here’s a brief rundown of the tools and tech stack that you’d need to consider to create a loan app.

- Development Frameworks: Consider using frameworks like Django or Spring Boot for backend development, and React or Angular for the frontend.

- DevOps Tools: Implement CI/CD pipelines using tools like Jenkins, GitHub Actions, or GitLab CI to automate testing and deployment.

- Security Tools: Use tools like OWASP ZAP or Burp Suite for security testing and vulnerability assessment.

- Monitoring and Logging: Integrate monitoring tools like Prometheus and Grafana, and logging solutions like ELK Stack (Elasticsearch, Logstash, Kibana) to track system performance and troubleshoot issues.

- Future-Proofing: Opt for tools that offer regular updates and long-term support to ensure your loan management system remains efficient, secure, and compliant with industry standards over time.

Consider partnering with experienced software development companies, like GoodCore, who can assist you in selecting and customising the most suitable tools for your needs.

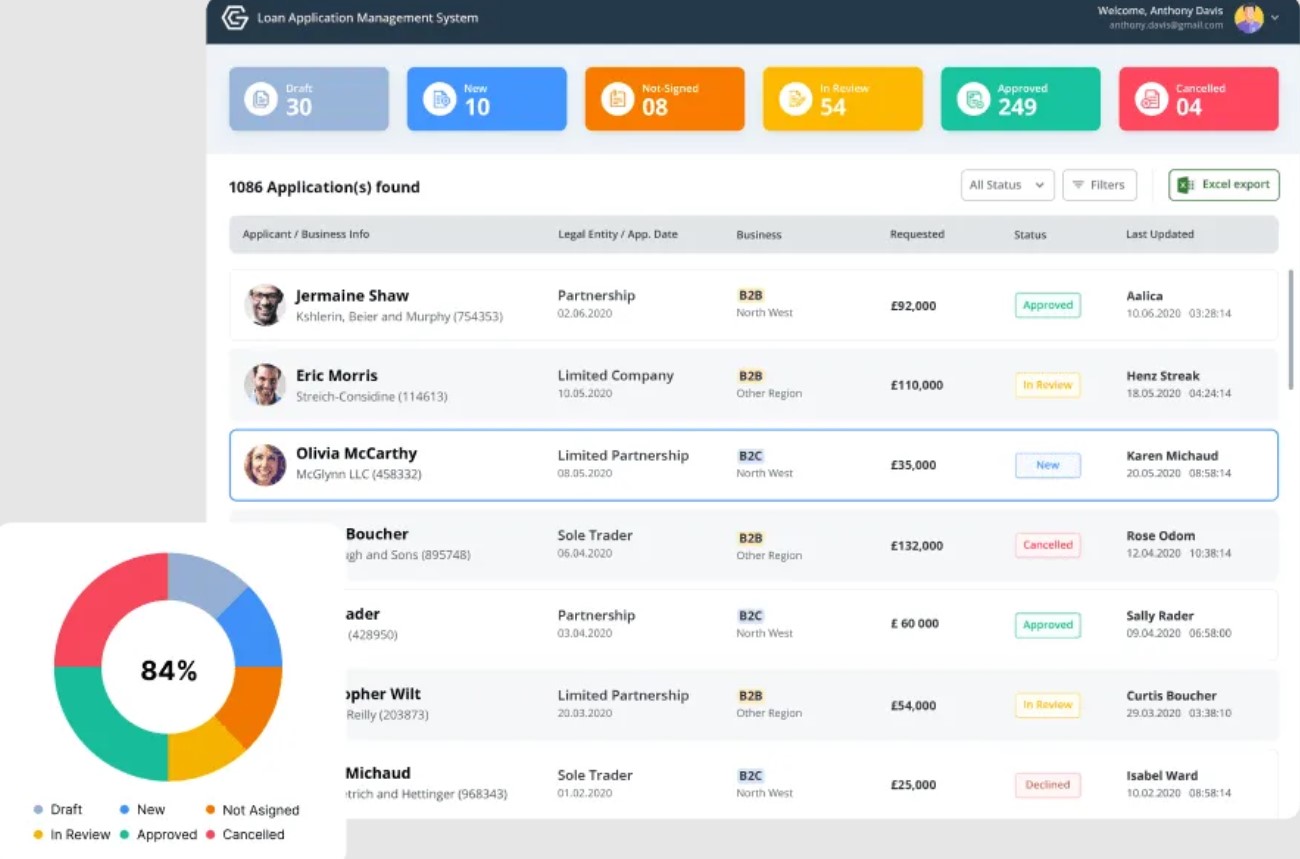

The GoodCore’s Expertise in Creating Loan Management Software

At GoodCore, we successfully developed and implemented a comprehensive loan management system tailored for a prominent UK-based financial institution specialising in loans secured against luxury assets. This bespoke system effectively streamlined their entire loan management process, from loan management app through to credit assessment, agreement management, and repayments.

Our solution automated many of the labour-intensive manual processes, enhancing efficiency and accuracy. By integrating advanced features such as automated credit scoring and risk assessment, the system provided robust support for decision-making, improving the speed and reliability of the loan approval process.

Furthermore, the loan manager software we designed featured sophisticated real-time monitoring and reporting capabilities, which allowed the client to keep a close eye on loan performance and borrower behaviours. Secure data management was a priority, ensuring compliance with stringent regulatory requirements and safeguarding sensitive client information against breaches. The integration capabilities of the system facilitated seamless interactions with other financial systems and APIs, enabling efficient data exchange and enhancing the overall user experience.

This project shows our technical expertise, as well as our commitment to delivering custom solutions that address specific client needs in Fintech software development.

Implementing Your Loan App

With the design and tool selection in place, it’s time to implement your loan management system.

Step 1: Developing the system modules

This involves building the various system modules, adhering to the design specifications.

- The loan origination module should capture all necessary applicant information, perform credit checks, and generate loan agreements. Integrate KYC (Know Your Customer) processes and APIs for credit scoring.

- The underwriting module should analyse borrower creditworthiness and make informed decisions. Use machine learning algorithms to enhance creditworthiness analysis.

- The repayment module should handle loan repayment schedules and automate payment processing. Implement automated ACH payments and integrate with payment processors like Stripe or PayPal.

Utilise a relational database like PostgreSQL for structured data and NoSQL for unstructured data to ensure flexibility and scalability. Ensure end-to-end encryption and multi-factor authentication (MFA) to protect sensitive data.

Step 2: Integrating the system components

Integrating the different system components is crucial for seamless operations. Connect the loan origination module with the underwriting and repayment modules to ensure smooth data flow and process automation. Also, integrate with external systems, such as credit bureaus and payment gateways, to facilitate credit checks and transaction processing.

Consider the following aspects for integration:

- API Integration: Use RESTful APIs for seamless communication between modules.

- Middleware: Implement middleware solutions like Apache Kafka for real-time data streaming and integration.

- Third-Party Integration: Ensure compliance with standards such as ISO 20022 for financial data interchange.

- Data Synchronisation: Use tools like Apache Camel for data integration and synchronisation across different systems.

Testing And Launching Your Loan App

After development and integration, it is important to thoroughly test your loan management software before its launch.

Testing is a critical phase in the development of any financial software system, ensuring that it functions as intended and meets the needs of its users.

Step 1: Conducting system tests

At GoodCore, we recommend conducting comprehensive tests after you create a loan app, including functional and security testing, to ensure a robust and error-free loan lending app development. Here’s how you can go about it:

- Functional Testing: Use automated testing tools like Selenium for functional testing.

- Security Testing: Employ tools like OWASP ZAP and Burp Suite for vulnerability assessment.

- Load Testing: Use tools like JMeter to simulate different user loads and analyse performance.

- Regression Testing: Implement continuous integration/continuous deployment (CI/CD) pipelines to automate regression testing.

Step 2: Resolving system issues

If any issues or bugs are identified during the testing phase, address them promptly.

Thoroughly validate and resolve all reported issues to ensure a stable and reliable system. Implement issue tracking systems like JIRA to manage bug reports and resolutions. Use continuous integration and continuous deployment (CI/CD) pipelines to streamline updates and patches.

Consider collaborating with a dedicated software development team, like GoodCore, to expedite bug fixes and minimise system downtime.

Step 3: Launching your system effectively

Before the final launch, create a detailed deployment plan, considering factors such as data migration, user training, and post-launch support. Communicate the launch internally and externally to ensure a smooth transition. Use data migration tools like Talend or Apache NiFi for seamless data transfer. Implement user training programs and provide comprehensive documentation and support resources.

Maintaining And Improving Your Loan App

Your loan management system requires regular maintenance and continuous improvement.

Ensuring the smooth operation of your lending management system is essential for the efficient running of your business. Regular maintenance tasks not only help in addressing security vulnerabilities but also contribute to the overall performance and longevity of the system.

Step 1: Regular system maintenance tasks

Schedule regular maintenance tasks using cron jobs or task schedulers. Use monitoring tools like Nagios or New Relic to track system performance. Ensure compliance with data protection regulations through regular audits and security assessments.

When it comes to system maintenance, it is important to follow a structured approach. This includes scheduling regular maintenance checks, testing system backups to ensure data integrity, and keeping track of any software updates or patches released by vendors. By staying proactive in your maintenance efforts, you can minimise the risk of system failures and data breaches.

Step 2: Enhancing system performance over time

Continuously assess your loan app performance and identify areas for improvement.

- Implement analytics tools like Google Analytics or Mixpanel to gather user insights.

- Use feedback management systems to collect and analyse user feedback.

- Plan and execute system updates and enhancements based on the collected data and industry best practices.

This iterative approach to system improvement ensures that your loan management system remains relevant and effective in a dynamic business environment.

Step 3: Adapting your system to changing needs

The process of how to create a loan app does not stop here. As your business evolves, it is crucial to adapt your loan management system to meet changing needs. Whether it’s supporting new loan products or integrating with emerging technologies, stay ahead of the curve to stay competitive. Here’s how you can ensure this:

- Keep your system adaptable by using modular and microservices architecture.

- Stay informed about technological advancements and integrate emerging technologies like blockchain for enhanced security or AI for improved decision-making processes.

- Regularly update your system to align with industry standards and market demands.

Future Predictions For Loan Lending App Development

In the future, loan management solutions will continue to evolve and leverage advanced technologies, such as:

- Artificial Intelligence and Machine Learning: AI and machine learning will increasingly automate tasks like credit scoring and risk assessment, enhancing the accuracy and speed of lending decisions, facilitating the development of loan automation systems.

- APIs and Fintech Integration: Integration with fintech platforms through APIs will facilitate seamless data exchange, offering a more personalised lending experience to customers.

- Blockchain Technology: Blockchain is set to transform loan management by utilising smart contracts for streamlining loan approvals, reducing fraud, and improving transparency, making the process more secure and efficient.

- Biometric Authentication: Future loan management systems may incorporate biometric verification methods, such as fingerprints or facial recognition, to bolster security against identity theft and ensure higher accuracy in borrower identification.

Final Take

Building a loan management software is a complex task that requires careful planning and execution. It involves understanding the unique requirements of your business and tailoring the system to meet those needs. GoodCore, with its years of experience in custom software development, can guide you through this process and help you build a robust and efficient loan management system.

Ready to transform your lending operations with a bespoke loan management software? At GoodCore, we bring over 18 years of full-service software development expertise to empower your company’s digital transformation. With an impressive 5.0/5.0 customer satisfaction rating and an average engagement period of 6.8 years, our UK office and global development centres are equipped to provide end-to-end support, from ideation to delivery. Whether you’re looking to enhance your business efficiency, disrupt the market, or drive end-user adoption, our skilled engineering talent is here to help.

FAQ

A finance lending software can streamline lending processes, reduce manual errors, improve operational efficiency, enhance customer experience, and ensure compliance with regulatory requirements.

Yes, loans management system can be customised to align with your unique business requirements. GoodCore, with its expertise in custom software development, can assist you in tailoring the system to your needs.

The time required to build a loan management system depends on various factors, such as the complexity of requirements, software tools selected, and development resources. Collaborating with an experienced software development company, like GoodCore, can help expedite the development process.

Robust loan management software solutions should incorporate security measures such as encryption, access controls, and regular security audits to protect sensitive customer data. Compliance with data protection regulations is also essential.

Yes, loans management software can be integrated with other systems and APIs. This allows seamless data exchange and enables functionalities such as credit scoring, payment processing, and fraud prevention.

To ensure smooth system integration, it is imperative to conduct thorough system testing and collaborate with experienced software developers who have expertise in integration processes. GoodCore’s experience in system integration can be a valuable asset in this regard.