It can be challenging to develop a habit of saving. However, you have the power to save. Even if you have to spend all of your spare cash on debt repayment, there are certainly some areas of your life where you might save money.

There might be ways to apply discounts that you aren’t taking advantage of.

The best money-saving apps can help you save money, no matter your current financial situation. Each app in this guide has its unique approach and ideas for saving money. Some apps can even help you save money on college textbooks, or earn passive income.

But, at their core, they’re intended to motivate you to start saving without overthinking it.

With that said, let’s begin.

Best Money Saving Apps to Consider in 2023

1. BookDeal

If you have massive college debt and want to save money as much as possible to repay them, the best way is to sell textbooks online. BookDeal makes it easy for you to sell your used books to numerous buyback vendors who will pay a high price.

Just type in your book’s ISBN, choose your preferred quote, and ship the textbooks for free. It only takes a few minutes to complete the buying process.

You get paid via Venmo, PayPal, or Zelle when the company receives your books.

Everything about using BookDeal is simple!

2. Vouchercloud

Vouchercloud is one of the most cost-effective shopping applications in the UK. The company has become one of the UK’s leading money-saving applications for shopping since its start in 2009. It offers an unrivalled collection of coupons and money-saving deals from thousands of renowned businesses.

It has also been released in several European countries, and it is now a part of Groupon’s vast online marketplace.

You can find plenty of ways to save money on Vouchercloud, whether you are looking for free delivery codes, takeaway and restaurant discounts, student or payday discounts, or money-saving bargains on holidays, fashion, etc. Saving money on electricity, broadband, and insurance is also simple by using the Vouchercloud comparison tool.

3. Monese

Monese gives you two options for saving money: interest accounts and savings pots. Savings pots are a terrific method to store money apart from your main account. However, they do not pay interest.

You can make pots in multiple currencies and take money out. You can also add up to ten different pots per account by rounding up your spare change. In addition, Monese has a marketplace relationship where you can open a savings account with interest if you are searching for a way to save with interest.

These interest accounts are guaranteed by the Financial Services Compensation Scheme (FSCS), so you can relax knowing that your money is safe.

Your selfie photo and ID are all you need to start a Monese account. There will be no credit checks. International money transfers, multi-currency accounts, and travel money are among the services provided by Monese.

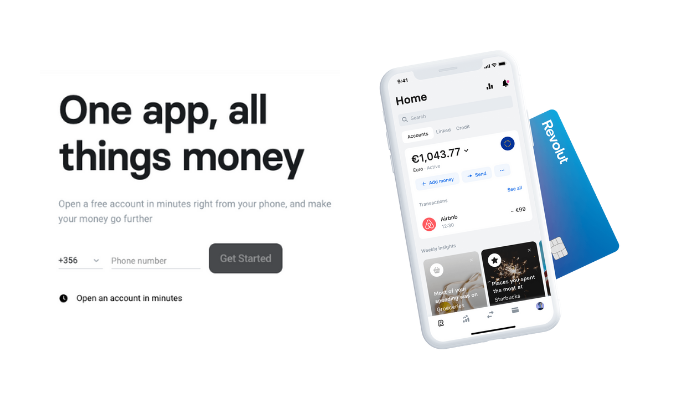

4. Revolut

Revolut is a money management and personal finance app that allows you to immediately budget, invest, save, and withdraw funds. You can fund your account with scheduled deposits and spare change or make one-time transfers to fund as you go with Revolut.

The app rounds up your transactions to the closest pound and stores the difference when using the round-up option. Money deposited in Revolut’s savings vaults is insured for up to £85,000 by the FSCS and is held by a reputable partner bank.

Revolut also lets you store your money in over 30 currencies, including commodities or cryptocurrencies. When you upgrade to Revolut Metal, you can get one per cent cashback on your Vaults.

It is completely free to sign up on Revolut and begin saving. Users can also upgrade to Plus, Premium, or Metal for £2.99/month, £6.99/month, or £12.99/month, respectively, to get more advanced features and cashback.

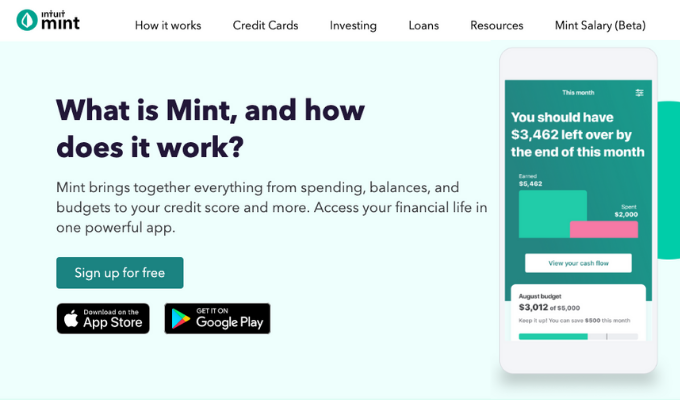

5. Mint

Multiple accounts are not always easy to manage – and, therefore, it is not suggested for organisations for that reason.

It is difficult to see a clear picture of your financial situation with too many focus points. However, if you are already in this situation, Mint connects all of your accounts to show your entire financial picture in one place.

It examines the inflow and outflow of cash in your wallet and offers budgeting tools to keep track of how much money you spend on things like accessories and vacations.

Mint provides you with a ton of useful personal finance features such as investment monitoring, loan management, property management, transaction history, spending limit, spend tracker, bills management and more. When your funds are low, the Mint app notifies you, so that you are aware of your financial situation and you can plan your expenses accordingly.

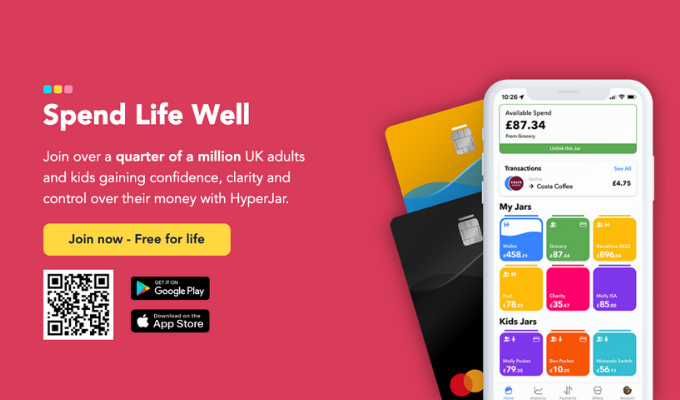

6. HyperJar

If you want to know where your money is going, the HyperJar app can assist. It groups every purchase, separating the beneficial from the not-so-useful.

The software allows you to sort your money into digital pots that you can allocate to categories like fashion, entertainment, grocery, etc.

In other words, you are limiting outgoings in specific areas, such as standing orders and direct debits, to certain limits. This is the money-saving equivalent of a “stop-loss.” All you have to do is select the relevant jar before making any MasterCard purchases.

When budgeting inside a home, HyperJar also allows you to share jars which act as virtual piggy banks for up to 30 people.

HyperJar has Mastercard and its prepaid debit card, but it can also connect with your bank account.

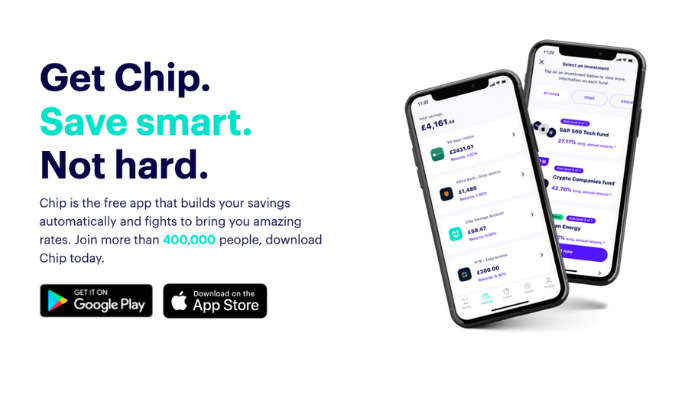

7. Chip

Chip helps you save money by detecting spare change, analysing your bank activities, and putting it aside for you automatically. You can choose to go all out or at a steady pace to save money faster by selecting the save level.

Before Chip moves your money, you can examine and edit each auto-save or choose to miss one entirely. Chip’s technology will learn from your changes and modify future saves accordingly.

Save Streaks and Payday Put Away are two attractive deposit options offered by Chip. You can also use the app to withdraw funds at any time.

Chip also has a feature that allows you to invest automatically.

Final Thoughts

These money-saving apps can help you improve your saving and spending habits. They provide numerous savings incentives, ranging from automatic savings features to goal setting and frequent spending insights to assist you in identifying areas where you can save money.

Also, if you have numerous used textbooks that you are not using, you can use BookDeal’s platform to resell them and get a significant portion of your money back.

Regardless of your decision, there is always a way to save money for your future goals.